COVID-19, Federal Financial Aid Headed to Hawaii

NEWS UPDATE – Monday, April 20th, 2020

Second Round Economic Relief Package Momentarily Stuck in the Mud of Politics

Negotiations between the Trump administration and Democrats to reach a final deal were not expected to finish Monday, congressional officials said, as they worked to resolve the disagreement. But Senate leaders scheduled a session for 4 p.m. on Tuesday, signaling optimism that they could resolve the issue and quickly approve the measure without a formal vote that would require senators to return to Washington.

Democrats are pushing to include a requirement in the agreement, which includes $25 billion for testing, that the government establish a national testing strategy, according to people familiar with the ongoing negotiations who asked for anonymity to disclose details.

Democrats have said that a national testing strategy is crucial to combating the further spread of the coronavirus and allowing states to plan for eventual reopening. Republicans, wary of placing the political onus on the administration to devise and carry out such a strategy, have argued that states should set their own plans.

Last week ago the Democratic controlled House of Representatives and the Republican-controlled Senate, finally reached an agreement on the first round of Federal financial aid for workers and business, in response to global pandemic which is having impacts of the nation’s new stay-at-home economy.

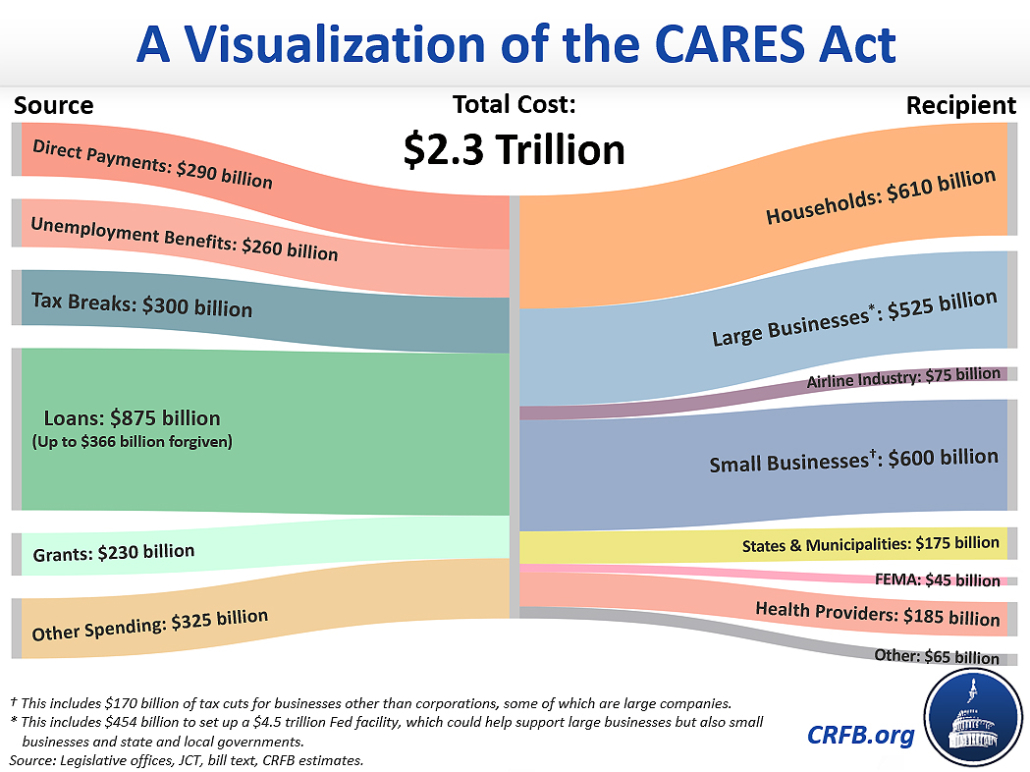

The Congressional aid package (CARES) included a massive $2 trillion coronavirus economic recovery package. The aid package also represented the largest emergency relief package in American history – includes billions to help those who are unable to work due to the outbreak, direct cash payments to millions of Americans, new funding for state and local governments, including at least $1.2 billion for Hawaii, and aid for small businesses, hospitals, and health care workers.

Key provisions in the financial aid package include:

Hospitals and health care workers – provides more than $130 billion to help hospitals, nursing homes, health centers, and health care workers across the country.

- Billions for personal and protective equipment for health care workers, testing supplies, increased workforce and training, new construction to house patients, an increase of the Strategic National Stockpile, medical research into COVID-19 and Medicare payment increases to all hospitals and providers.

Unemployment assistance – provides $260 billion to help those who have lost their jobs or are experiencing reduced incomes.

- Available to self-employed individuals, part-time workers, independent contractors, and gig workers, including ride-sharing drivers.

- Covers those who are sick, quarantined, furloughed, or whose family circumstances keep them from working or reduce their pay as a result of the coronavirus outbreak or government containment efforts.

- Aid will cover salaries up to about $65,000 for 4 months.

At least $1.2 billion for Hawai‘i – funding to the state and county governments that will help pay for Hawaii’s response efforts.

Direct cash payments – provides a one-time cash payment to millions of Americans.

- Individuals will get $1,200 (joint filers get $2,400) plus $500 per child.

- Benefits start to phase out for those with incomes exceeding $150,000 for married couples, $75,000 for individuals, and $112,500 for single parents.

- Payments will not go to single filers earning more than $99,000; head-of-household filers with one child, more than $146,500; and more than $198,000 for joint filers with no children.

Small businesses and non-profits – provides $377 billion for small employers, including restaurants, hotels, and non-profits.

- $350 billion in partially forgivable loans to small businesses and non-profits to maintain existing workforce and help pay for other expenses like rent, mortgage, and utilities.

- $10 billion for Small Business Administration (SBA) emergency grants of up to $10,000 to provide immediate relief for small business operating costs.

- $17 billion for SBA to cover 6 months of payments for small businesses with existing SBA loans.

Large employers – provides $500 billion to keep the biggest employers, including airlines, and their workers on the job.

- Protects collective bargaining agreements and prevents employers from firing employees.

- Extends health care benefits for airline contract workers.

- Prohibits stock buybacks or dividends for the length of any loan provided by the Treasury plus one year.

- Restricts increases to pay for top executives.

Leave a Reply

Join the Community discussion now - your email address will not be published, remains secure and confidential. Mahalo.