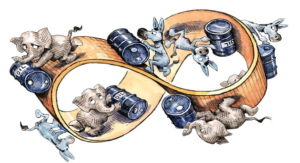

GOP Gift to Big Oil & Billionaires

Editorial

You’re likely already aware of the most recent Republican-led effort to dismantle President Biden’s primary one-term achievement: introduction and passage of the highly successful IRA (Inflation Reduction Act) into law; the IRA offered a long overdue national funding platform that successfully launched America on a path into a globally competitive Clean Energy economy.

The current attack on the highly successful IRA legislation includes was a package of taxpayer gifts directed at fossil-fuel and polluter interests. Most notable is the GOP’s financial elimination all EV (electric vehicle) tax credits, one of the many accomplishments of the 2023 bipartisan passage of the IRA clean energy bill.

The current attack on the highly successful IRA legislation includes was a package of taxpayer gifts directed at fossil-fuel and polluter interests. Most notable is the GOP’s financial elimination all EV (electric vehicle) tax credits, one of the many accomplishments of the 2023 bipartisan passage of the IRA clean energy bill.

This past week, the GOP (aka the Gas.Oil.Pollution party) with complete control of the House of Representatives, voted to advance a mega dirty energy bill that firmly shifts America into Reverse on all things associated with advancing the nation’s clean energy economy, including vehicle electrification. President Trump promises to bring back coal. Not sure if he intends to bring back coal-burning steamboats and locomotives as well.

The Republican bill inappropriately named “One Big Beautiful Bill Act“ has the potential to devastate electric vehicle sales in the U.S. The bill now goes up for a vote in the Senate at an as-yet-unannounced time. A Princeton University study cited this week that if Republicans succeed in repealing the EV incentives, electric vehicle sales will make up just 24 percent of new car sales in 2030 in the U.S. If incentives remain in place, EVs are projected to make up 40 percent of new car sales by the same year, further reducing America’s dependency on fossil fuels.

The GOP’s bill narrowly passed through the House this past week, by a single vote! The act eliminates EV and clean energy tax credits. Adding salt into the wound, the legislation adds a $250 per year EV car-driver tax. That’s correct, if you own and/or drive an electric vehicle you will soon be paying for a wholly newly created Federal tax. William F. Buckley is rolling over in his grave right now. Oh yes, Hybrid gas-electric vehicle owner-drivers will not escape the GOP’s wrath either, but because they mostly burn gas and not electrons they will only be taxed $100 annually, lucky them.

The bill also eliminates a key EV incentive, the Federal $7,500 purchase credit most middle income buyers have relied on to aid their step in Ev ownership. The $4,000 EV credit given on the purchase of used vehicles is also eliminated, along with the loss of the $1,000 credit on the home installation of Level 2 EV chargers.

Electric vehicles are not the only victims of the House bill which further eliminates tax credits for PV solar installations help generate clean energy and lessen grid power demands for residential and commercial settings. Altogether the loss of funds will especially impact Hawaii’s home grown rooftop solar energy economy.

If the House bill passes in the Republican-controlled Senate and then will most assuredly be signed into law with Trump’s scribble, it will also further enable a national policy shift designed to gut the Country’s investment in clean energy and slow growing public support for a clean energy economy, beginning with a large scale transition to EV’s.

The nation’s emerging BEV battery manufacturing sector is also being targeted, impacting primarily Red States invested in an emerging national clean energy transition. Included in this policy roll-back are domestic EV production plants and jobs, growth in the advanced battery technology sector, electric vehicle component design and manufacturing, along with an emerging domestic industrial sector addressing end-of-life battery re-manufacturing sector. All this and more will be negatively impact by the President’s to roll-back the clock on technology and sustainability advancements within America’s industrial and manufacturing sectors. These are only few examples of US economic sectors benefiting from the IRA system of grants, loans, and business development enablers in a 21st century global economy.

What’s also at stake is defeating national advancements now lessening America’s oil dependencies and costs of a fossil-fueled dependent economy; which increasingly are reflected in rising public healthcare, climate, social and environmental costs across America and the world.

So the party of Gas-Oil-Polluters (GOP) eliminates tax credits for EVs, but, their not satisfied with just crippling the growth of clean transportation, their House bill also targets domestic solar and wind, and energy efficiency improvements from cars-to-refrigerators-to factories. For some unknown reason, today’s GOP power players view efficiency when applied to a sustainable economy as a waste of time and money that they are neither invested or interested in… and their priorities are wrong; period.

So the party of Gas-Oil-Polluters (GOP) eliminates tax credits for EVs, but, their not satisfied with just crippling the growth of clean transportation, their House bill also targets domestic solar and wind, and energy efficiency improvements from cars-to-refrigerators-to factories. For some unknown reason, today’s GOP power players view efficiency when applied to a sustainable economy as a waste of time and money that they are neither invested or interested in… and their priorities are wrong; period.

Today’s growing clean energy economy continues to save Americans money, addresses a toxic business-as-usual environment of pollution, natural destruction, and all within the challenges and impacts of an increasingly hotter world.

Yet, today we have a President and “his” party minions enacting tax cuts for billionaires funded by everyone else who pays the bills. Any national policy firmly fixed on the past, rolls back progress as its national agenda, and by intention ignores science-based realities is simply misaligned in priorities and focus on today’s choices and tomorrow’s consequences.

Leave a Reply

Join the Community discussion now - your email address will not be published, remains secure and confidential. Mahalo.