Hawaii Prepares To Go All Electric

Hawaii’s 2022 legislative season, now in session has been marked a record number of bill submissions addressing the forthcoming electrification of personal and commercial ground transportation, as in battery electric vehicles (BEV). Equally remarkable are the number transformative bills directed at addressing climate change, renewable energy, and environmental protection.

According to then state’s leading electric vehicle group, Hawaii Electric Vehicle Association, and there are over 43 separate House and Senate bills addressing EVs (electric vehicles), in one form or another, ranging from the state guidelines and incentives to assist the build out of a multi-island BEV public charging infrastructure to addressing equity (affordability) issues, with BEV financial incentives directed to Hawaii’s low-to-moderate income residents.

For definitive look at the BEV related bills now under Hawaii state legislative consideration visit: https://hawaiiev.org/2022-ev-legislation

A National EV Charging Infrastructure is also Coming to Hawaii

Senator Brian Schatz’s office reported earlier this week of new Federal Funding being allocated to Hawaii in the form of $2.6 million funding grant. the money is part of $5 Billion immediate Federal funds release for the intended build out of national EV charging network. Funding details are available on DOT’s web site: https://highways.dot.gov/newsroom/president-biden-usdot-and-usdoe-announce-5-billion-over-five-years-national-ev-charging

The $5B Federal funds release represents about 2/3 of the total $7 Billion allocated to BEV charging infrastructure in the bi-partisan infrastructure bill passed last year.

For Hawaii, here some of the high points;

1) The state has until August (this year) to submit its deployment and use of funds plan to DOT. The earlier Hawaii responds, the earlier the funds will be distributed to the state.

2) The funds may only be applied to charging station build-outs on so-called designated Alternative Fuel Corridors, i.e., federal roads within the state. All of the state’s primary populated islands have qualifying roads. In other words, state parks, shopping malls, etc. do not qualify in this initial round of Federal funding.

3) The funding is a 80/20 package, meaning private partners participating in the state’s build out plan, e.g., HECO will be required to pay 20% of their project participation costs. The balance (80%) is covered within federal funding and administered by the state.

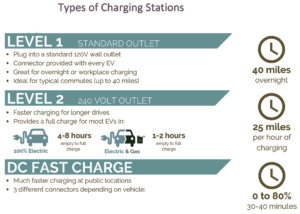

4) Questions as to the charging speed, type of charging, and locations for deployment are yet to be determined. The state, and its private sector partners, are to submit a final funding plan by August, which is then subject to final approval by DOT, before the $2.6 million Federal is released to the state — and all of which is scheduled to occur this year.

A National EV Charging Infrastructure

- The new National Electric Vehicle Infrastructure Formula (NEVI) Program was established by the Bipartisan Infrastructure Law passed by Congress and signed into law by President Joe Biden last November

- The U.S. Departments of Transportation and Energy also announced this week nearly $5 billion will be made available to help states create a network of EV charging stations along the Interstate Highway System and designated “alternative fuel corridors.” Funds can be used to install and operate EV charging stations

- There is currently 41K BEV charging stations compared to 136K gas stations with greater fueling capacity in terms of the number of vehicles fueled at one time and time for fueling.

- The Federal funding goal is to develop a nationwide highway network of 500,000 EV charging stations by 2030.

- There are 116,000 public charging ports / 41,000 stations across the country, according to the Energy Department — mostly lower-speed “Level 2” chargers that are heavily concentrated in California. Cost estimates for installing chargers vary widely. Tesla has proposed the government cap costs at $75,000 per port, which would mean 80,000 chargers with the new federal funding and matching state dollars.

- The American Association of State Highway and Transportation Officials suggested the new federal funding was an opportunity to ensure prices for charging are listed in terms of kilowatts per hour and to require that charging can be paid with credit and debit cards, rather than through an account with charging providers. (the latter is a long overdue recommendation)

- Various groups disagree about the proximity of chargers. A group of Western state transportation departments said the current 50-mile standard was hard to meet in rural areas. But the Alliance for Automotive Innovation, which represents major carmakers, said the distance should be closer to offer convenience similar to filling up at a gas station.

- The federal government will consider a particular corridor fully built out when it has at least four 150-kilowatt charging points every 50 miles, with limited exceptions. Once states meet that goal, they can use their remaining money for other charging projects (potentially faster charging DC power options).

“People want to purchase EVs, but they worry about where and when they’ll be able to charge their car. By building EV charging stations across the state in places where people can actually use them, this new federal funding will make EVs more accessible for Hawaii families, create quieter streets, and help the State of Hawaii achieve its ambitious goals for building a clean economy,” said Hawaii’s Brian Schatz, who presently chairs the Senate Appropriations Subcommittee on Transportation, Housing and Urban Development.

Auto Dealers and Retailer Outlets Apprehensive

Analysts say higher prices at the dealership represent a conflict rather than a conversance of interests as to role of dealerships in the future of BEV sales. For legacy auto manufacturers, this is a problem only now surfacing and could very well slow expansion of the nation’s nascent BEV sector.

While climate scientists continue to present evidence as to the urgent need to eliminate carbon emissions from transportation, many traditional auto dealers see EV’s as a threat to their livelihood.

Sticker prices for hybrid and electric vehicles have fallen significantly over the past decade, but remain out of reach for the typical car buyer, and recently added pricing barriers of entry for new EV buyers is even a greater market challenge for auto dealers. Pricing premiums of $10,000 or more over MSRP for sought-after electric vehicle models, e.g., Ford’s Mustang Mach-e and F150 Lighting all electric pick-up truck, and Nissan’s forthcoming Ariya crossover are increasingly standard practice.

F-150 Lightning customers have only recently been able to convert their reservations into firm orders, while Ford has been receiving buyer complaints that certain dealerships are raising prices well above MSRP on the vehicles they ordered. Overpricing will certainly dent the reputation of the truck, Ford and its new EV offerings.

Ford and GM’s warnings to their dealer networks not to overprice their new EV models expose a tense undercurrent developing between legacy carmakers and dealers.

It’s more than a threat to business-as-usual for dealerships. Newer and emerging electric vehicle manufacturers like Tesla, Rivian and Lucid are now sell directly to buyers, in effect, eliminating the middleman.

At the same time, legacy automakers are banking on consumers to migrate to electric vehicles even as dealers worry they may adopt a direct-sales formula for EVs, following the start-up success of Tesla, and in effect edging them out of a market that’s projected to balloon to nearly $1 trillion by 2030.

The challenge for manufacturers is to bring their dealer networks into the 21st century

Just because legacy manufacturers are pivoting to EVs, experts say, automakers cannot simply ditch their dealer partners.

Manufacturers mostly don’t want to handle the real estate obligations of sales and service or the logistics of moving finished products. Dealers also have deep expertise in direct sales and local marketing. They know how to get customers in the door and into new cars. Manufacturers in many cases don’t want to take on those specialties. The transformation of the century old industry remains a work in progress, and EV’s, like their zero-to-sixty performance, just sped up that process.

Leave a Reply

Join the Community discussion now - your email address will not be published, remains secure and confidential. Mahalo.