Road Taxes, Electric Vehicles and Hawaii’s Future

New developments in battery technology, and the promise of a growing number of electric vehicles to choose from in various price ranges has some Hawaii legislators on edge. In “the sky is falling” of knee-jerk legislation last year, SB 409 was born.

For additional information on electric vehicles (EV’s), and their role in Hawaii’s future, we invite you to visit the July 2019 edition of Hawaii Today: https://www.beyondkona.com/ev-adoption-linchpin-to-hawaiis-transportation-and-clean-energy-future/

SB 409, and its companion introduced in this current 2020 session as SB3111, are designed to collect from the small group of Hawaii’s Electric Vehicles owners road maintenance fees traditionally collected in the form of taxes on fossil fuel (gas/diesel) sales. If you ask most of Hawaii’s EV owners they’ll likely tell you …sure we’ll pay our way, but is this right approach and the right time?

Instead, SB409 (2019) and SB 3111 (2020) have in effect, added uncertainty and economic barriers of entry to EV ownership for Hawaii’s driving public.

EV’s represent barely 1% of all registered vehicles in the state of Hawaii, and both bills are designed to address a problem that does not yet exist, and will not exist for some time to come. So instead, our legislators created another tax (something we do best here in Hawaii) and one that promises to further slow Hawaii’s already modest growth path to electric vehicle ownership, and as a result, slow the advancement of Hawaii’s transition to clean energy and climate change mitigation.

—

BeyondKona asked one of our island experts on the subject, Bernard Moret, EV owner and board adviser to Big Island Electric Vehicle Association (BIEVA) for his thoughts on the subjects of road taxes, electric vehicles, and Hawaii’s future in electrified transportation.

On road taxes, electric vehicles, and Hawaii’s future

Bernard Moret, guest editor

A transition to 100% renewable energy, not just for electricity production, but for all land-based activities, is crucial to the future of the state.

Hawaii is blessed with plentiful solar, wind, and geothermal energy, but is currently relying on fossil fuels for most of its electrical production (KUIC on Kauai is far ahead of HECO on the other islands) and for all of its transportation.

State and county policy makers have studied approaches to meeting the state’s goal of 100% renewable energy production by 2045 and the counties’ goal of total decarbonization of their vehicle fleets by 2035. Much has been made in the last year of state studies aimed at maintaining funding for the road system in the face of anticipated decreases of revenue from the gasoline tax due to increased adoption of battery-powered electric vehicles (BEVs) by the public. Because these discussions all take place in the context of the state’s and counties’ efforts to move to 100% renewable energy sources, the first finding is simply that the only reasonable path open to us is through clean production of electrical energy and electrification of all land transportation. So, where are we along this path?

To date, only modest efforts have been made by HECO to tap into renewable sources of energy, but this will change in keeping with the state’s mandate. Yet, the environmental contribution EV’s provide to the state’s other goals in the advancement clean energy and climate mitigation is generally discounted at the legislative level.

The contribution EV’s play in advancing the state’s clean goal will likely manifest themselves in two significant ways.

- 1- Creation of an EV charging infrastructure will drive a resistant statewide utility (HECO) to shift their power production capacity to clean and renewable energy in order to meet the growing demand for EV-driven clean power demand, while incorporating the same cost-saving efficiencies of 21st century grid operations.

- 2- A natural extension of EV ownership to homeowner and commercial installed Solar rooftop power production, completing the cycle and fueling opportunity from sun-to-vehicle.

Specific to the transportation front, the expected decrease in gasoline consumption has not yet happened in Hawaii, in fact, last year saw a 3% increase in gasoline consumption — an unfortunate development as it also means an increase in pollution. However, adoption of BEVs has started to modestly ramp up; state, counties, and power companies are working on setting up a network of charging stations; and discussions have started on a proposed road tax for BEVs. Road maintenance needs, of course, will not change even when all vehicles on the road are BEVs.

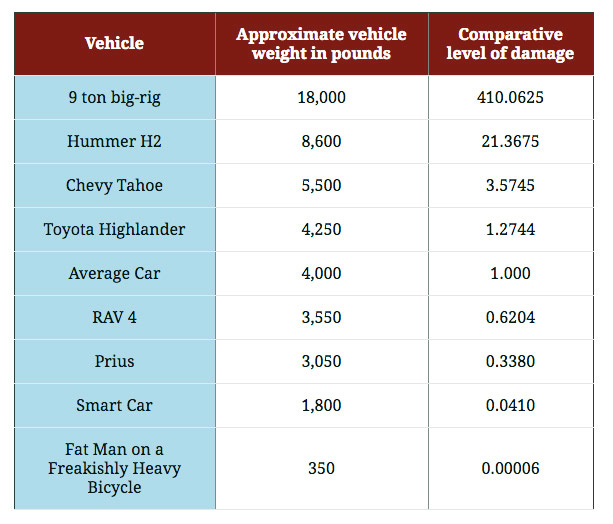

Road damage from vehicles is almost entirely a function of their weight. Government and state studies show that a single 18-wheeler loaded to its federal maximum of 80,000 lbs does 10,000 times more damage to the road than a midsize car. In other words, almost all of the road damage is due to large commercial transports: dump trucks, tanker trucks, 18-wheelers, etc. Put another way, drivers of personal vehicles subsidize road maintenance through the gasoline tax — accounting nationwide for over 60% of the revenue, while causing less than 1% of the road damage.

In the diagram below various vehicle weights and their ratios are represented by the level of road damage, compared to the average car.

We will not discuss here whether such a subsidy is fair: after all, everyone on the islands needs access to groceries, consumer goods, medical supplies, etc., all of which need to be hauled from harbors to distribution and sale points. What we are saying here is that personal vehicles (including light-duty trucks) do so little damage to the roads that distinguishing among them, or even worrying about their annual mileage, is unimportant.

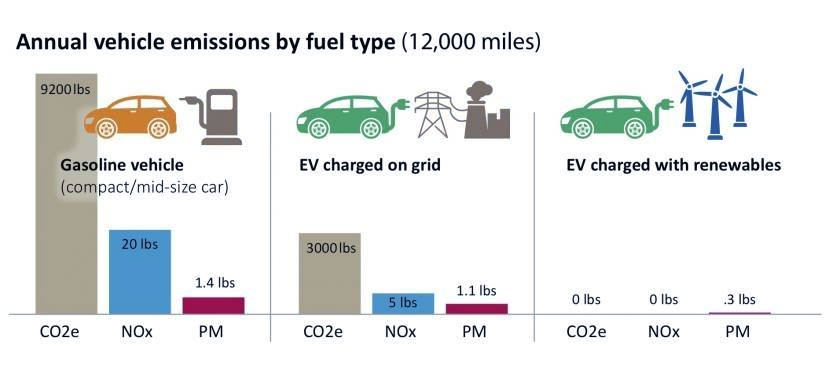

Currently the gasoline tax affects only drivers of vehicles with internal combustion engines (ICE), according to the efficiency of their vehicle (thus encouraging the adoption of more efficient vehicles) and to the mileage driven. Any BEV makes much more efficient use of energy than any ICE vehicle (including hybrids): EPA figures show that the most efficient ICE cars barely reach 39 mpg, the best non-plugin hybrids up to 55 mpg, but BEVs are all between 100 mpg and 135 mpg equivalent. Thus, as more of the total miles driven on the island are driven using BEVs, energy consumption gets reduced and pollution gets reduced even more.

There have been proposals to tax the electricity used for charging BEVs in an attempt to mirror the gasoline tax as closely as possible, but such proposals make little sense, for two reasons. First, they would require extensive additional infrastructure, both public and private, to measure that energy. Second, as noted, the difference in total mileage driven (or total energy used) has almost no effect on road damage. A much simpler mechanism is to add the road tax to the annual vehicle registration tax. This added amount could be fixed or computed on a sliding scale (charging expensive vehicles more so as to reduce the impact on residents with modest incomes). Given the efficiency and cleanliness of BEVs, imitating the gasoline tax by making the road tax dependent on mileage for BEVs is counterproductive.

The best solution is thus to continue taxing ICE and hybrid cars using the current gasoline tax and start using a road tax, as an extra sum paid with the registration fee, for BEVs, one that is independent of mileage, but progressive (charging more for expensive cars) so as to protect residents with modest income.

We should keep in mind that electric transportation will not only be a major contributor to Hawaii’s energy independence, but also bring huge benefits in terms of quality of life. BEVs produce no emissions of their own; thus, after 2045, when electrical production is 100% renewable, all electric transportation will be clean — whereas today it is responsible for over one third of the pollution in the state!

In addition, BEVs are much simpler mechanically than their ICE counterparts (no gears, no transmission, very few moving parts) and thus last much longer and require almost no maintenance, resulting in a much lower cost of ownership.

BEVs are silent except for tire noise. BEVs are statistically much safer than other cars: less than 1 accident per 2 million miles for BEVs vs. over 4 accidents for other cars — and, thanks to the rigidity of the structure that holds a BEV’s battery, the BEV driver is better protected than the ICE driver in case of accident.

The transition to electric transportation and a clean future is under way in our state and we should let our representatives know that we want them to do their best to facilitate that transition, including by setting a simple and reasonable policy for funding road maintenance.

—-

Bernard Moret was born in Switzerland, moved to the US in 1976, received his PhD in Computer Science in 1980, became a US citizen in 1984, and worked as a faculty member at the U. of New Mexico from 1980 till 2006 and at the Swiss Institute of Technology in Lausanne from 2006 to 2016, doing research in computational biology on the evolution of genomes. With his wife, he moved to the Big Island of Hawaii in 2016 and now lives in a home powered by solar panels that also recharge his electric car.

Categorically a road usage tax is regressive, unfair, and bad public policy.

I propose Hawaii residents actively oppose removing the Hawaii gas tax and add a vehicle value tax is much better public policy.

To remove a gas tax is yet another giant gift the fossil fuel industry. Again, this is an industry that has not taken responsibility for the vast environmental damage to air, land, water, and ocean. Also consider the damage and costs to human health! (Just ask the residents of Richmond CA how they like living next to a large oil refinery.) https://www.sfgate.com/bayarea/article/Fire-at-Chevron-refinery-in-Richmond-3767221.php

A road usage tax is punitive, regressive, and burdens those among us that are least able to pay. Where is the social justice in this tax proposal? Here on the big island there are many people that work in the trades and service/tourism industry that often have long commutes to earn a living. Less wealthy people on other islands also have long commutes to employment. They are forced to live outside of population centers because that is where they can afford housing. Not everyone can afford an expensive condo in town.

Hawaii DOT is not listening or thinking about the impact of the road usage tax proposal on all Hawaii citizens, just the oily lobbyists of the fossil fuel industry. Furthermore, removing a gas tax is counter to the state’s 2045 clean energy goals.

I had dialogue, on multiple occasions with individuals in the HiRUC and explained why a road usage tax was a bad idea, only to be rebuffed. The projected road funding deficit can be easily met by 1) keep the fossil fuel tax, AND 2) add a tax based on the value of the vehicle.

Many other states fund their roads with a vehicle value tax. Vehicle value data can be easily obtained from a number of sources. This vehicle value tax would sunset the current electric vehicle tax.

A vehicle value tax would include all vehicles, regardless of fuel source. It is essentially a self-imposed tax (if one wants to own a red Ferrari to do their best Magnum PI impression, they’ve just chosen their tax). I also explained a road usage tax creates a financial incentive for people to tamper with their car odometer. I think it is bad public policy that encourages people to potentially flout the law.

It also bothered me there was not a clear case for a RUC, the claim being that gas tax revenue will not meet future needs. Less than 1% of Hawaii’s vehicles are currently electric. It just didn’t make sense! Then I found it, further subsidies to the fossil fuel industry and the real motivation for Road Usage Charge: http://www.ncsl.org/research/transportation/road-use-charges.aspx

A road usage tax is bad public policy!

Mahalo for your consideration,

-KN